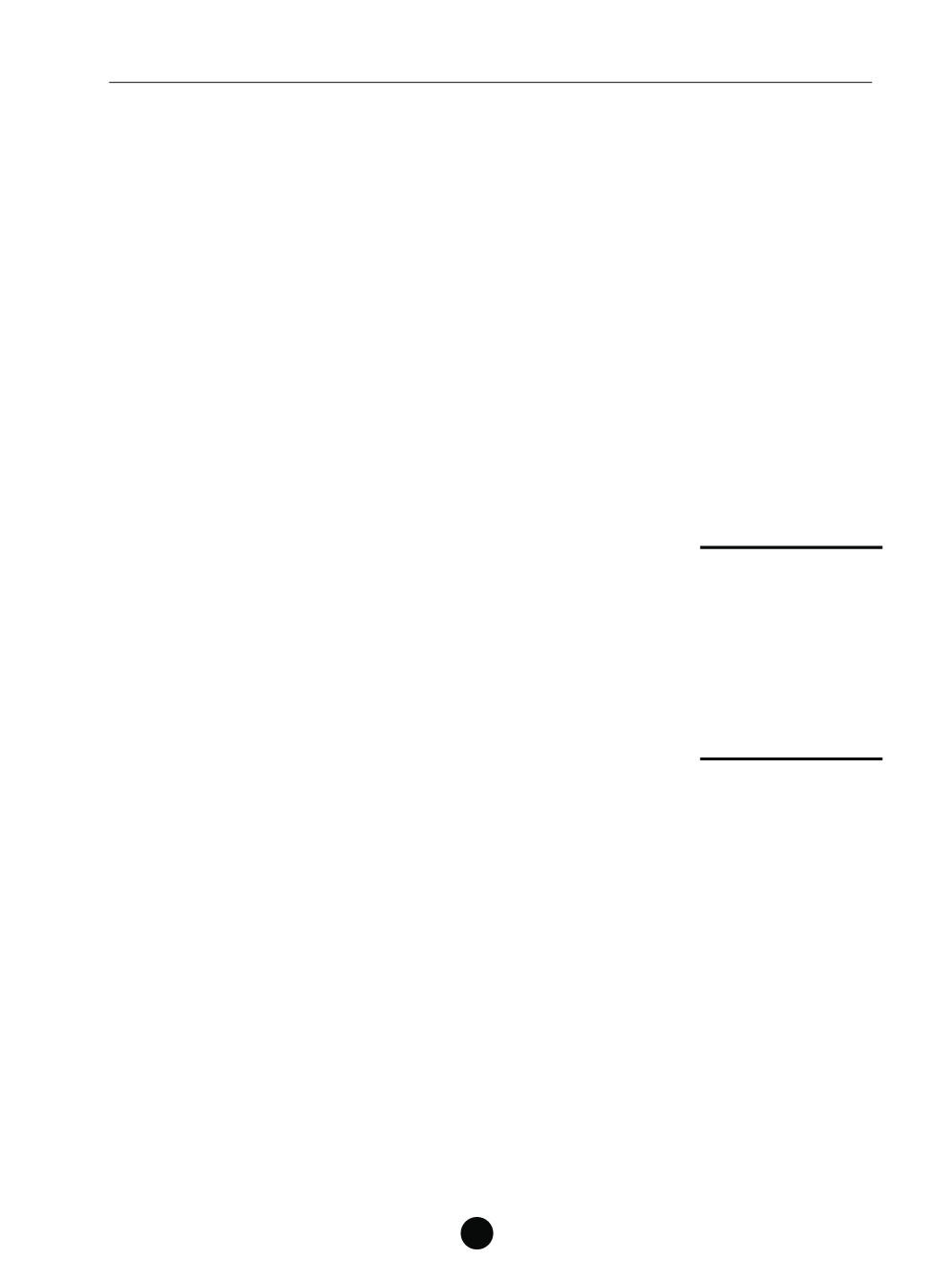

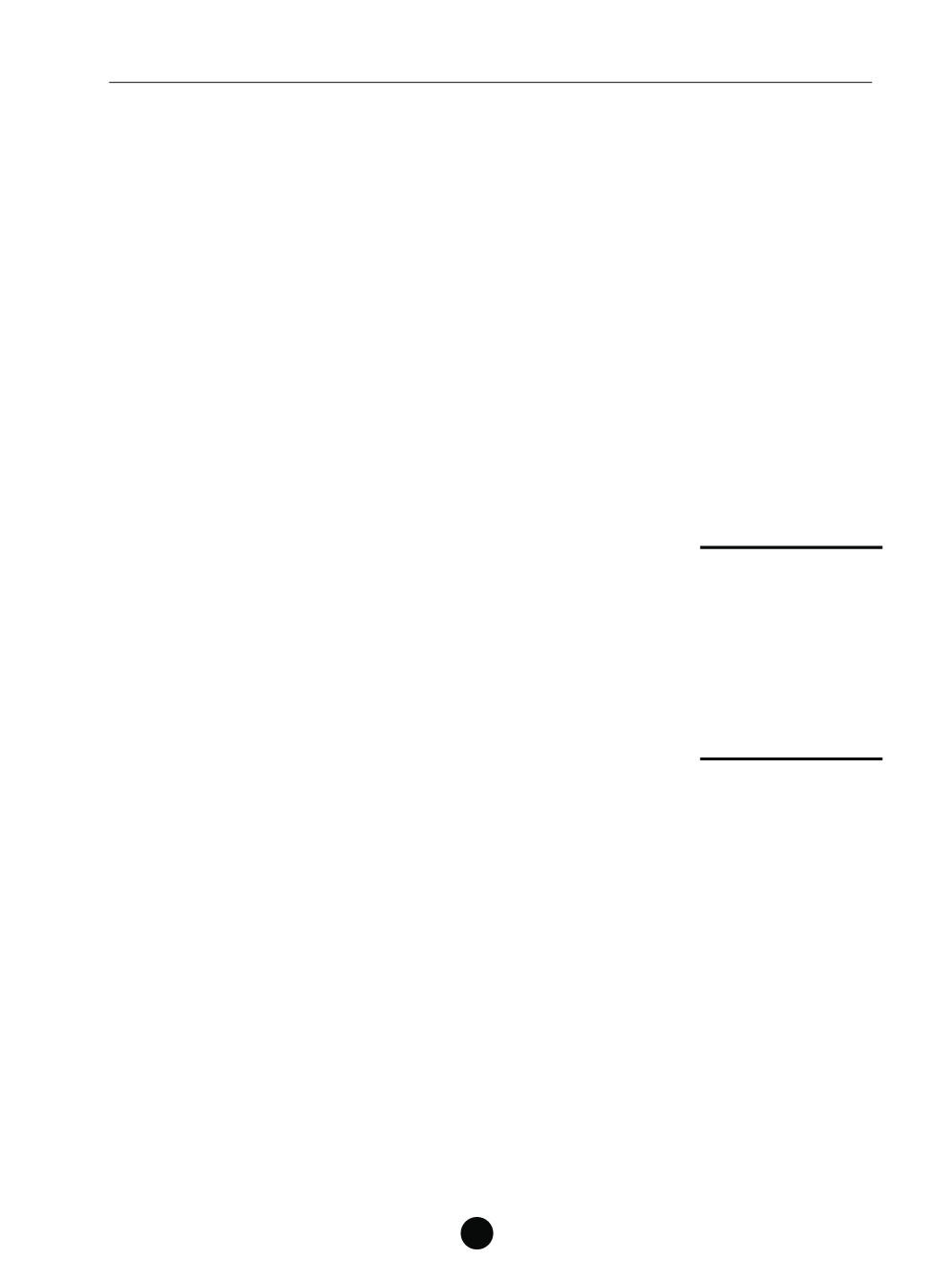

10 BORROWINGS (CONTINUED)

Terms and borrowings repayment schedule (continued)

Nominal

Year of

Face

Carrying

Trust

Currency

profit rate

maturity

value

amount

%

$’000

$’000

2014

Term Commodity

Murabaha Facility B (New)

SGD

*SOR+Margin

2016

90,000

89,355

Revolving Commodity

Murabaha Facility D

SGD

*SOR+Margin

2016

28,500

28,500

Term Commodity

Murabaha Facility F

SGD

*SOR+Margin

2017

75,000

73,111

Term Commodity

Murabaha Facility C (New) SGD

*SOR+Margin

2019

30,000

29,151

Loan from a subsidiary

SGD

4.50%

2017

72,500

71,756

Loan from a subsidiary

SGD

4.00%

2018

90,000

89,371

Loan from a subsidiary

SGD

4.25%

2019

100,000

98,985

2013

Term Commodity

Murabaha Facility C

SGD

*SOR+Margin

2014

100,274

99,876

Term Commodity

Murabaha Facility E

SGD

*SOR+Margin

2015

177,563

174,867

Revolving Commodity

Murabaha Facility D

SGD

*SOR+Margin

2016

30,500

30,500

Term Commodity

Murabaha Facility F

SGD

*SOR+Margin

2017

75,000

72,471

Loan from a subsidiary

SGD

4.50%

2017

72,500

71,510

* Swap Offer Rate

(a) Commodity Murabaha Facilities

During the year ended 31 December 2014, the Group refinanced the $100.2 million Term

Commodity Murabaha Facility C and the $177.6 million Term Commodity Murabaha Facility E,

ahead of their maturities in November 2014 and August 2015 respectively, with part of the net

proceeds from the issuance of Trust Certificates under the Trust Certificates Programme (defined

below) and the drawdown of the $90.0 million Term Commodity Murabaha Facility B (New) and

$30.0 million Term Commodity Murabaha Facility C (New) under the new $243.0 million Commodity

Murabaha Facilities granted to the Group in November 2014.

NOTES TO THE FINANCIAL STATEMENTS

Year ended 31 December 2014

SABANA REIT

|

ANNUAL REPORT 2014

119