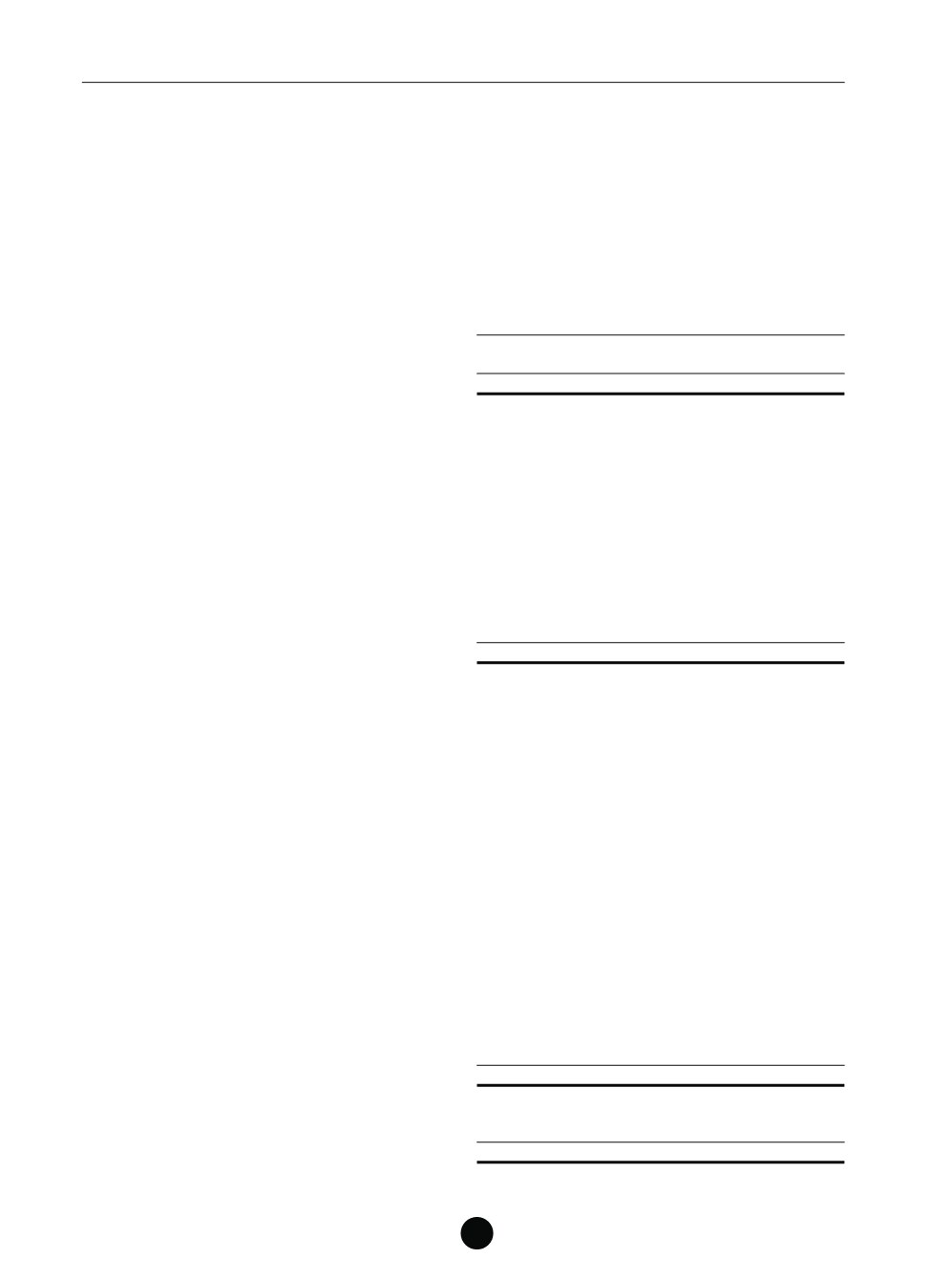

7 TRADE AND OTHER RECEIVABLES

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Trade receivables

522

483

522

483

Other receivables

6,713

5,235

6,713

5,235

Deposits

993

299

993

299

Loans and receivables

8,228

6,017

8,228

6,017

Prepayments

491

392

484

390

8,719

6,409

8,712

6,407

The Group and the Trust’s exposure to credit risk related to trade and other receivables, excluding

prepayments, are disclosed in Note 15.

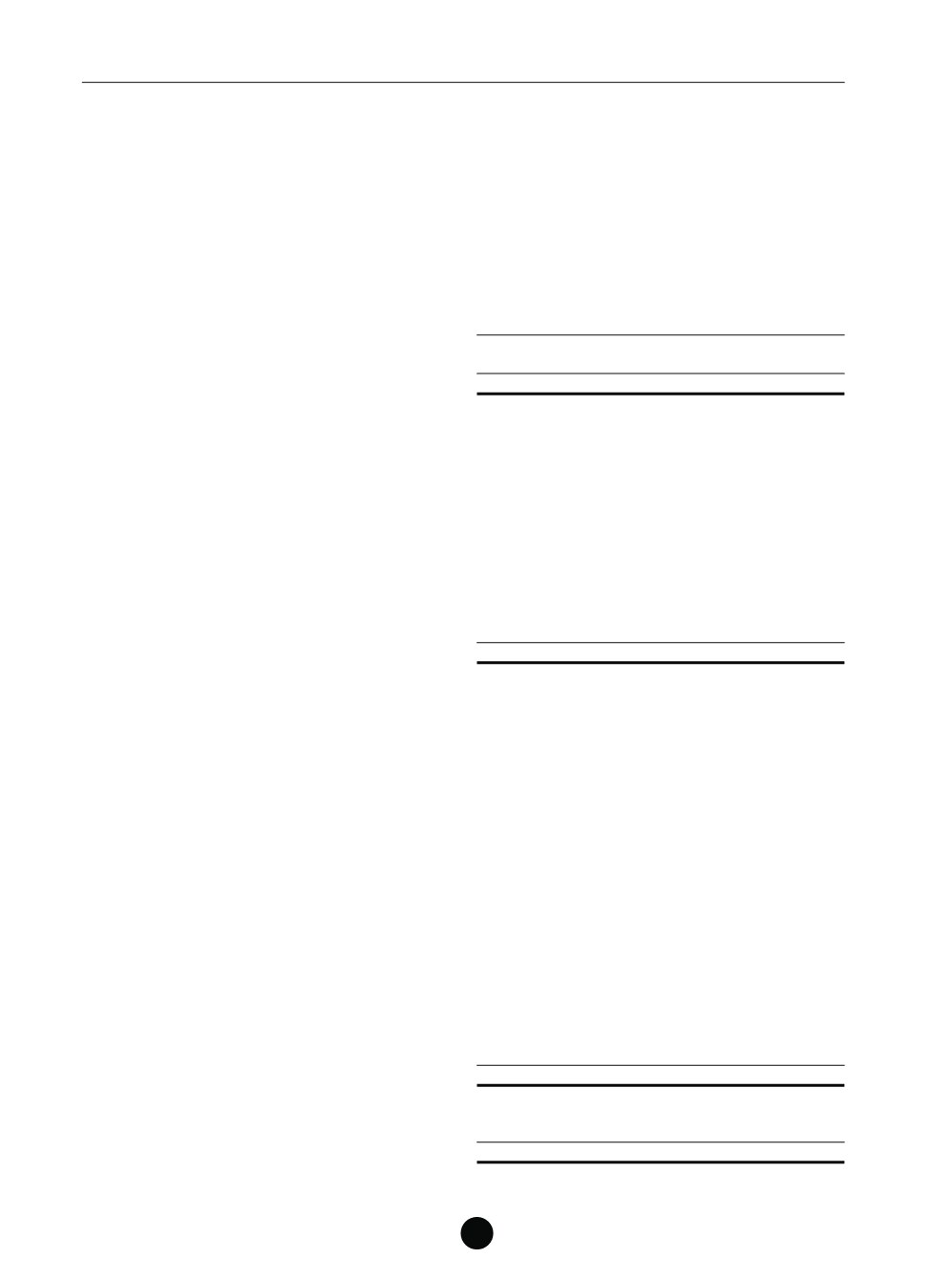

8 CASH AND CASH EQUIVALENTS

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Bank balances

2,507

7,084

2,502

7,078

Fixed deposits

9,780

10,000

9,780

10,000

12,287

17,084

12,282

17,078

The weighted average effective profit rate relating to cash and cash equivalents at the reporting date for

the Group and the Trust is 1.01% (2013: 0.48%) per annum.

9 TRADE AND OTHER PAYABLES

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Amount due to related parties, trade

684

674

694

686

Trade payables

1,774

2,818

1,774

2,818

Security deposits

15,095

12,164

15,095

12,164

Rental received in advance

1,406

301

1,406

301

Retention sums

893

921

893

921

Finance costs payable to:

- non-related parties

3,710

2,162

793

1,297

- subsidiaries

–

–

2,917

865

Accrued operating expenses

2,464

4,128

2,463

4,127

Others

1,983

2,327

1,967

2,311

28,009

25,495

28,002

25,490

Current

14,803

18,869

14,796

18,864

Non-current

13,206

6,626

13,206

6,626

28,009

25,495

28,002

25,490

NOTES TO THE FINANCIAL STATEMENTS

Year ended 31 December 2014

SABANA REIT

|

ANNUAL REPORT 2014

116