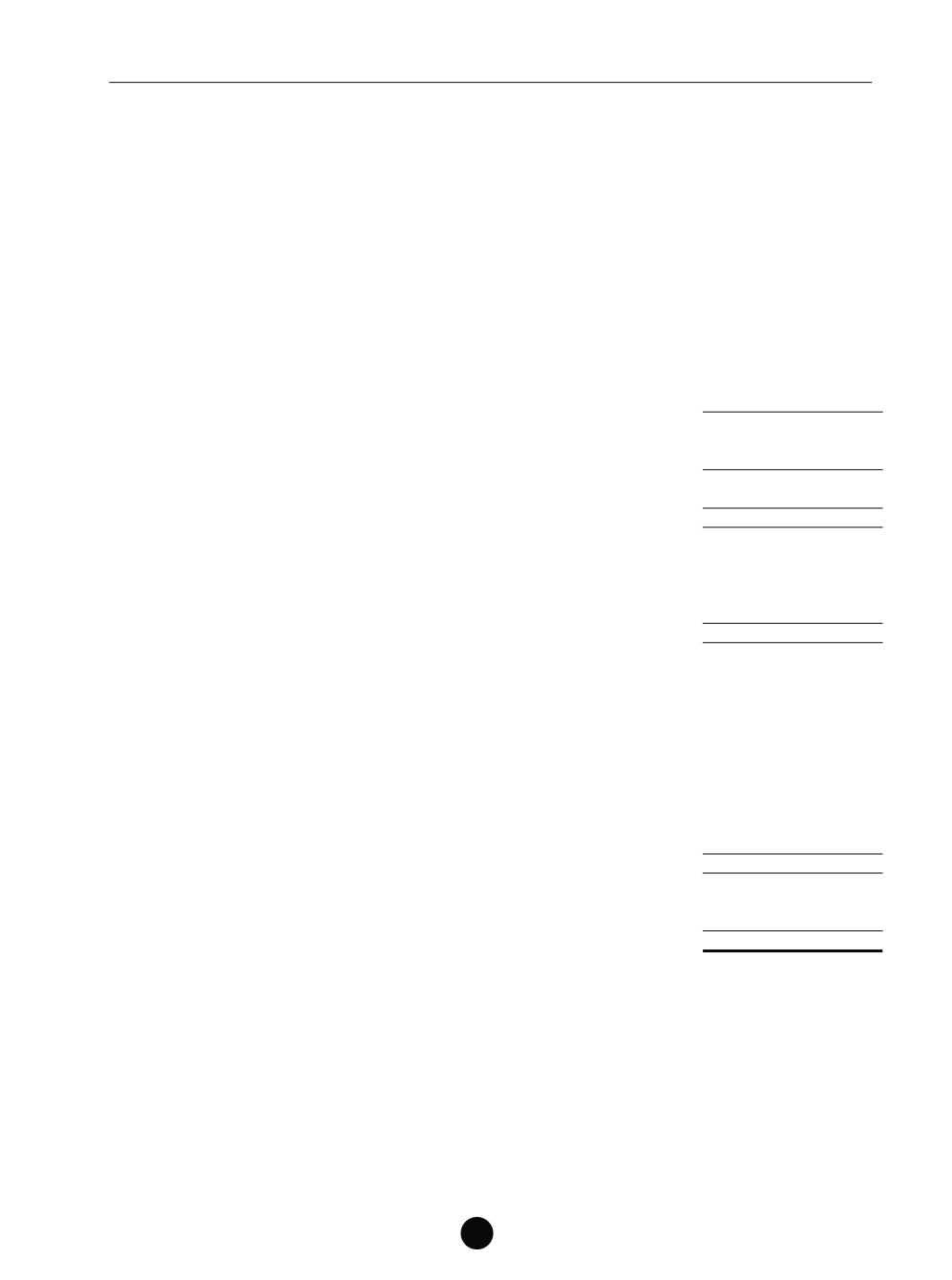

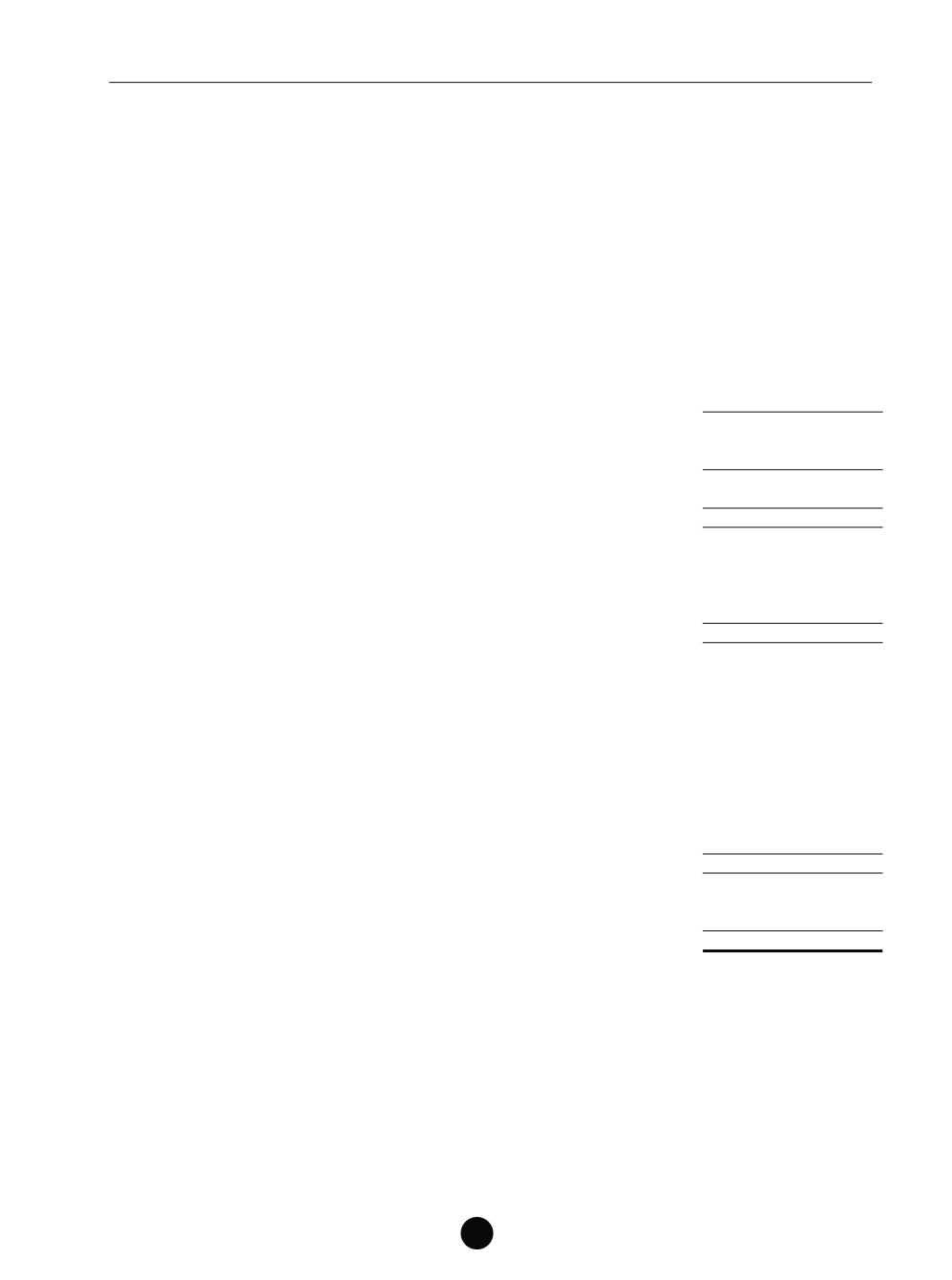

CONSOLIDATED STATEMENT OF CASH FLOWS

Group

Note

2014

2013

$’000

$’000

Cash flows from operating activities

Total return for the year after taxation and before distribution

36,905

63,388

Adjustments for:

Amortisation of intangible assets

1,383

1,427

Manager’s fees paid/payable in Units

A(i)

4,938

4,694

Net change in fair value of financial derivatives

(5,298)

(1,393)

Net change in fair value of investment properties

7,501

(12,441)

Loss on conversion of Convertible Sukuk

A(ii)

–

1,228

Net finance costs

24,483

20,249

69,912

77,152

Change in trade and other receivables

(2,310)

(3,036)

Change in trade and other payables

728

1,025

Cash generated from operations

68,330

75,141

Ta’widh (compensation on late payment of rent) received

41

14

Net cash from operating activities

68,371

75,155

Cash flows from investing activities

Capital expenditure on investment properties

(1,216)

(81)

Purchase of investment properties

A(iii)

(32,453)

(67,965)

Profit income received from Islamic financial institutions

41

47

Net cash used in investing activities

(33,628)

(67,999)

Cash flows from financing activities

Proceeds from issue of new Units

–

40,000

Break costs on prepayment of borrowings

(909)

–

Break costs on termination of profit rate swaps

(1,617)

–

Proceeds from borrowings

310,000

60,500

Repayment of borrowings

(279,837)

(30,000)

Issue expenses paid

(74)

(633)

Transaction costs paid

(3,378)

(684)

Finance costs paid

(15,582)

(16,147)

Distributions paid

A(iv)

(48,143)

(62,073)

Net cash used in financing activities

(39,540)

(9,037)

Net decrease in cash and cash equivalents

(4,797)

(1,881)

Cash and cash equivalents at beginning of the year

17,084

18,965

Cash and cash equivalents at end of the year

12,287

17,084

For the year ended 31 December 2014

The accompanying notes form an integral part of these financial statements.

SABANA REIT

|

ANNUAL REPORT 2014

99