SEO Version

ANNUAL REPORT 2011

13

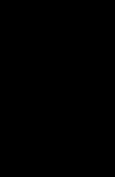

The expanded Sabana Shari ’ah Compl iant REIT

portfolio also reflects greater asset type diversification.

For example, the portfolio allocation to high-tech

properties in terms of GFA and property value decreased

by approximately 8.0%. The Manager believes that

the improved diversification of the Sabana Shari’ah

Compliant REIT portfolio in the areas of asset type,

tenant base and industry strengthens the Trust’s position

to provide Unitholders with stable income distributions.

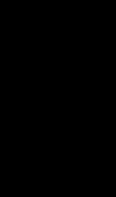

Weighted Average Master Lease Expiry by Gross

Revenue (based on initial IPO portfolio)

(7)

Weighted Average Master Lease Expiry by Gross

Revenue (based on enlarged portfolio)

(8)

Portfolio Composition

Asset Type by GFA

2011

2012

2013

2014

2015

2011

2012

2013

2014

2015

2016

59.5%

49.4%

40.5%

9.6%

37.7%

3.3%

Initial Portfolio

at IPO

(9)

Enlarged

Portfolio

(10)

Enlarged

Portfolio

(10)

Initial Portfolio

at IPO

(9)

■

High-Tech Industrial

44.0%

■

Chemical Warehouse

& Logistics

17.6%

■

Warehouse & Logistics

28.7%

■

General Industrial

9.7%

■

High-Tech Industrial

36.1%

■

Chemical Warehouse

& Logistics

14.5%

■

Warehouse & Logistics

33.6%

■

General Industrial

15.8%

■

High-Tech Industrial

59.2%

■

Chemical Warehouse

& Logistics

16.3%

■

Warehouse & Logistics

18.9%

■

General Industrial

5.6%

■

High-Tech Industrial

50.9%

■

Chemical Warehouse

& Logistics

14.0%

■

Warehouse & Logistics

23.9%

■

General Industrial

11.2%

Asset Type by Property Value

(7) Based on 14 properties that excludes 9 Tai Seng Drive, which is

not on master lease.

(8) Based on 18 properties that excludes 9 Tai Seng Drive which is

not on master lease and 1 Tuas Ave 4. No rentals were collected

for 1 Tuas Ave 4 in November and December 2011. The Manager

is in advanced stage of negotiation with a party for a 10-year lease

for the whole building. The existing Master Lease is set to expire in

approximately 23 months. This property constitutes approximately

2.7% of total portfolio value.

(9) Based on 15 properties.

(10) Includes the acquisitions of the properties at 6 Woodlands Loop,

39 Ubi Road 1, 3A Joo Koon Circle, 21 Joo Koon Crescent and

2 Toh Tuck Link.

Powered by FlippingBook Publisher